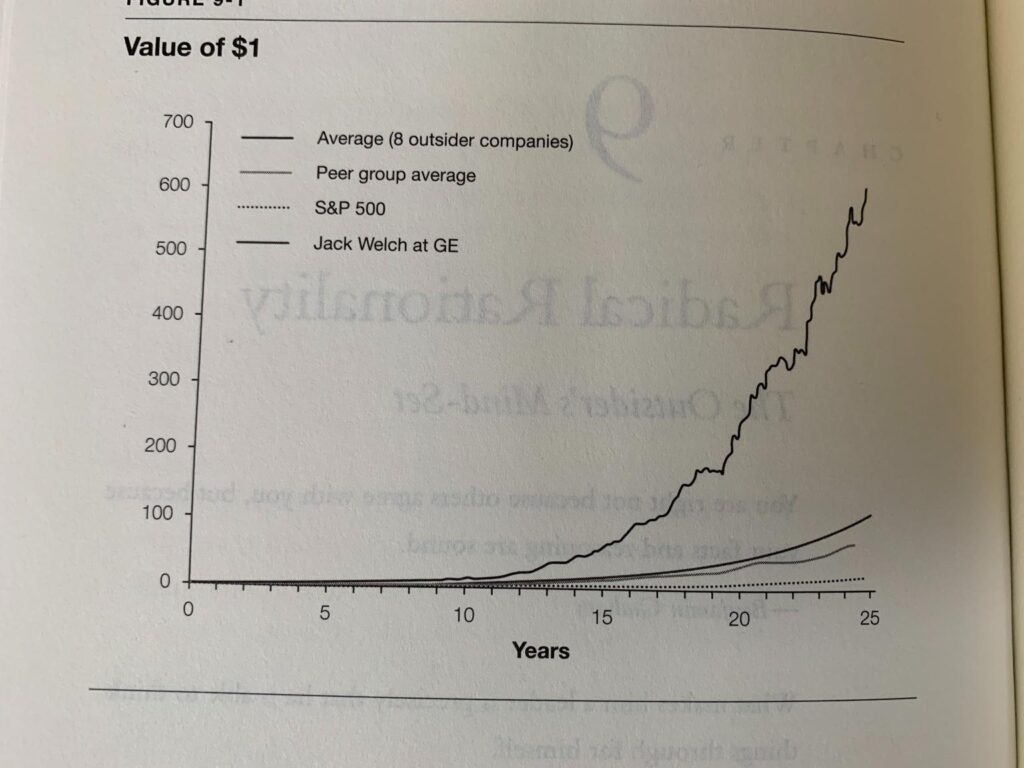

A great tale of lesser known eight unconventional CEOs, who ran their companies to maximize shareholder value. A dollar invested in these companies, on average, became $688 during 25 years these CEOs were at the helm, easily dwarfing the returns from S&P!

What these 8 CEOs had in common?

They were master capital allocators! Whereas most CEOs spend majority of their time worrying about operational and functional aspect of the business, these iconoclast bunch of CEOs focussed on improving cash flows and delegated other work to people on the ground.

In William Thorndike‘s own words, “they disdained dividends, made disciplined (occasionally large) acquisitions, used leverage selectively, bought back a lot of stock, minimized taxes, ran decentralized organizations, and focused on cash flow over reported net income.”

Special mention to John Malone – former CEO of Tele-Communications Inc (TCI) – who first popularized the term “EBITDA”, which is now the most widely used metrics in valuing a company.

No wonder book was #1 on Warren Buffett’s recommended reading list in 2012 annual shareholder letter.

My Rating: 4/5

Get freshly brewed hot takes on Product and Investing directly to your inbox!