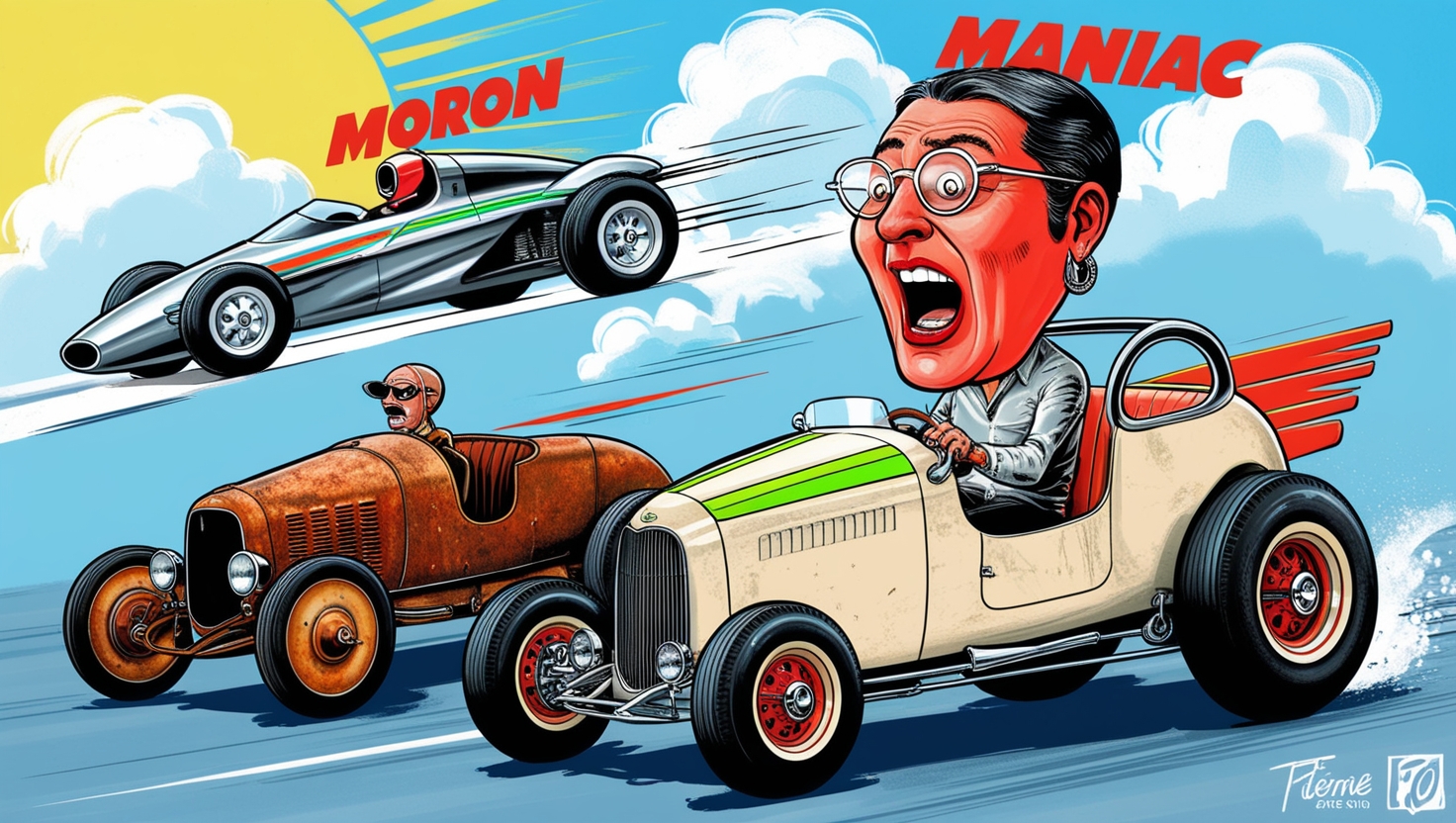

I recently heard an analogy on a podcast that really struck a chord with me:

“Most people think those driving slower than them are morons, and anyone driving faster than them is a maniac.”

This simple observation holds a powerful lesson for Product Managers and Investors alike. We’re constantly navigating a landscape filled with differing perceptions, opinions, and feedback—often juggling multiple perspectives that may or may not be accurate.

For me, this analogy acts as a pulse check—a reminder not to get caught up in how others perceive things, and more importantly, to reality-check my own perceptions. It’s all too easy to fall into the trap of thinking others aren’t moving fast enough or are moving too fast. But in reality, everyone’s pace is different—and that’s perfectly fine.

The Role of Balance in Product Management

As product managers, we’re responsible for balancing customer feedback, stakeholder input, and market trends. It’s essential to filter the noise and focus on what truly drives value. Not every piece of feedback needs to be implemented, just like not every perceived roadblock is a reason to slam the brakes.

Being too reactive or too dismissive can harm the product. Staying self-aware and grounded in data, strategy, and long-term vision helps avoid extremes—whether that’s moving too cautiously or speeding ahead recklessly.

Staying Grounded

At the end of the day, the key to great product management (and investment, for that matter) is staying grounded. Keep your vision clear, trust the process, and recognize that each product or investment will have its own rhythm. Some will need to move fast, while others might take a slower, more methodical approach.

Next time you’re in a meeting or reading a user review, think about that analogy—about how we view others on the road. It’s a useful reminder that just because someone else is moving at a different pace doesn’t mean they’re wrong. It’s all about finding the right speed that works for the journey you’re on.

So, whether you’re driving the roadmap of a product or charting the course of an investment, remember: stay focused, self-aware, and grounded in the bigger picture.

Get freshly brewed hot takes on Product and Investing directly to your inbox!